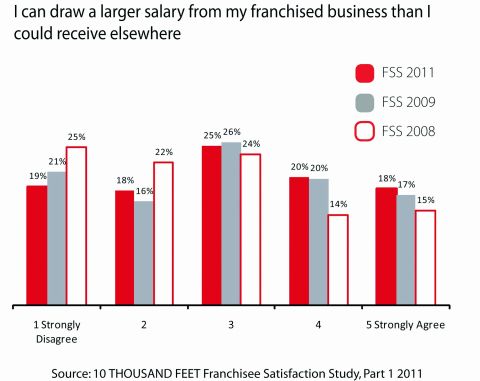

Research from 10 Thousand Feet, a market research consultancy, examines from a franchisees’ perspective what salary can be drawn through the business and the return on investment available for capital invested from the start.

Ian Krawitz, who heads up 10 Thousand Feet, explains. “Survey on survey we have seen an improvement across the industry with franchisees’ believing they will be able to get a good return on investment; up five percent across the board and two percent up on their belief that they can draw a larger salary than they could receive elsewhere.”

Krawitz says franchise companies who continue to perform well in this area are most likely to have a good business model, have realistic expectations of the work involved during the franchisee recruitment process, and a good idea of the potential profitability of the business. They will also have strong systems in place to educate franchisees on how to maximise their returns, he suggests.

However, when it comes to financial rewards most franchisees have to wait until their third year of business until they become highly profitable.

“So be realistic in your search of franchise opportunities and get a sense of what it will take to achieve your goals and how long it will take for you to be drawing the salary you want from the business, as well as getting into the position where you have an attractive asset to on-sell to someone else,” Krawitz advises.

Here are two different business models and approaches that have worked well for current franchisees, says Ian Krawitz. In the 10 Thousand Feet topfranchise.com.au Financial Awards, both have performed well in the financial rewards category.

Smartline Personal Mortgage Advisers

The mortgage industry has a very attractive business model, which at present includes recurring revenue. A mortgage broker gets commission upfront for arranging a home loan; then for the life of the home loan the mortgage broker receives a small percentage of the loan. This is an attractive proposition for a franchisee who is continually rewarded for their initial hard work and can build the business with a reliable monthly income. The other attractive element is that as a loan book is built up it becomes a saleable asset, making a return on investment a good proposition. Smartline also has a low initial investment into the business, enabling franchisees to get a good return on their capital.

Mister Minit

This unique model sees staff members become franchisees; in this transition franchisees just pay for stock and do not pay for any fit out or licence fees. What is also unusual about Mister Minit’s model is that during the term of the agreement the franchisee does not build up an asset. At the end of the term, the agreement is either renewed or not; there is no opportunity for the franchisee to sell the business. This model leads to a great focus on the here and now and making sure franchisees are financially profitable and able to take home a healthy salary throughout the course of their franchise agreement.

Typically the transition from staff member to franchisee has resulted in a salary increase of two to three times, depending on the shop, the number of days the franchisee works and the number of staff employed. This model results in great satisfaction when it comes to being able to generate a greater salary than could be achieved as an employee.