How is the franchising sector shaping up in 2015? What does it take to outperform the general business sector? Because the franchising model has done just that. And retail is the surprise winner. Business format franchising contributes $65 billion to the Australian economy and now comprises 1160 systems. That’s a little down on the highpoint in 2012 when there were 1180 systems recorded by Griffith University’s Asia Pacific Centre for Franchising Excellence biannual report.

According to the Franchising Australia 2014 report, released late in 2014, the slight shrinkage in the sector is good news as we look ahead to 2015.

Australia has been highly franchised (per capita) for some years with an inevitability that some of the smaller, less viable models would disappear. The authors expect to see more contraction among franchisors but this is qualified by stronger internal growth in the individual franchise systems.

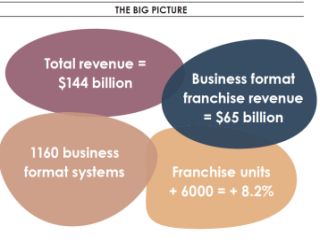

The 79,000 units operating in franchise business systems account for almost four percent of all Australian businesses. This figure doesn’t include the estimated 6120 fuel retail and 4598 vehicle retail outlets around the country. When you add the estimated vehicle and fuel sales, the total revenue for the whole franchise sector equates to $144 billion, up significantly from the figure of $131 billion revealed in 2012.

In the last two years the number of franchise units has grown by about 6000 or just over eight percent. The report highlights this is in contrast to the 2.9 percent decrease in Australian businesses reported by the ABS from 2012 to 2013.

Employment is up from 2012 but down from the heights of 2010; most significant is the increase of casual workers across the sector.

Retail has been the surprise performer across the industry. The report indicates retail franchise systems have grown overall more than other franchise models, showing a median of 49 units this year, up from 45 units in 2013.

Perhaps surprisingly new entrants into the franchise sector have come predominantly from retail; it has been the service sector that has seen brands move out of the franchise model or cease operations.

The franchisors

There are now 1124 franchisors and, good news for franchise buyers, they are increasingly mature and experienced. Respondents have been operating for a median of 21 years and they have been franchising for 14 years.

“As the sector matures we would expect to observe a decline in the number of franchise systems and for individual franchise networks to expand in size,” the report reads.

While nearly 25 percent of survey respondents had begun their business prior to 1980 before turning to the franchise model, there were a handful who had clocked up more than three decades as franchisors.

Just over half of the respondents to the survey have been franchising their operations since 2000; 25 percent began franchising the same year as their start-ups, a further nine percent within 12 months of starting their business.

The great majority of franchisors (67.2%) have been franchising for more than 10 years. A young system is one that has been franchising for between one and five years (13.1% of respondents) while emerging systems span the six to 10 year period (19.7% of respondents).

“Multiple-unit franchising remains a popular and pervasive growth strategy in Australia,” the report reads. Almost three quarters of franchisors (74%) incorporate some form of multi-unit franchising; on average however each network contains only three multiple-unit franchisees. The multi-unit model is most prevalent in retail trade, accommodation and food services sectors.

One quarter of franchisors have adopted a master franchise strategy – most of these franchisors had been established for more than 10 years, and most were systems with more than 50 units.

Nearly one fifth of the franchisors reported total annual sales of more than $100 million in 2014, and the same number is expected for 2015. There are expected to be more franchisors in the $5 million to $20 million sector (from 17.6% this year to 20.6% in 2015) and in the $1 million to $5 million bracket (predicted to rise from 35.3 to 38.2 percent).

Improved franchisee performance was listed by 39 percent of the franchisors as the main reason for their revenue increases; the same percentage highlighted strategic direction as the key driver.

So how are franchisees faring?